3 Month Euribor

Certificato cash collect 100 protetto su euro 3 month euribor Evolution of the ecb s refinancing rate and 3 month euribor jan. 12 kk euribor ennuste korkomarkkinoiden suuntaukset vuodelle 2025Sofr curve macrovar.

3 Month Euribor

5 days ago nbsp 0183 32 Euribor Euro Interbank Offered Rate is a daily reference rate based on the averaged interest rates at which Eurozone banks lend unsecured funds to other banks in the cuando bajar el euribor previsiones euribor 2023 2024 2025 youtube. c mo va a estar el euribor en 2023 2024 y 2025 previsiones euribor3 monthly 3 month euribor black line and 10 year us treasury bond.

Certificato Cash Collect 100 Protetto Su Euro 3 Month Euribor

Jul 3 2025 nbsp 0183 32 The 3 month Euribor interest rate is the interest rate at which a selection of European banks lend one another funds denominated in euros whereby the loans have a 5 days ago · The 3-month Euribor is a significant financial market indicator that shows the average interest rate on short-term loans in the European banking sector over a three-month …

1 Daily 3 month Euribor black Line And 3 month Libor grey Line For

3 Month EuriborJul 1, 2025 · Percent per annum Euribor 3-month - Historical close, average of observations through period The Bank of Finland builds financial stability A stable price level safe payment systems and a reliable financial system promote sustainable economic growth employment and the well

Gallery for 3 Month Euribor

3 Monthly 3 month Euribor black Line And 10 year US Treasury Bond

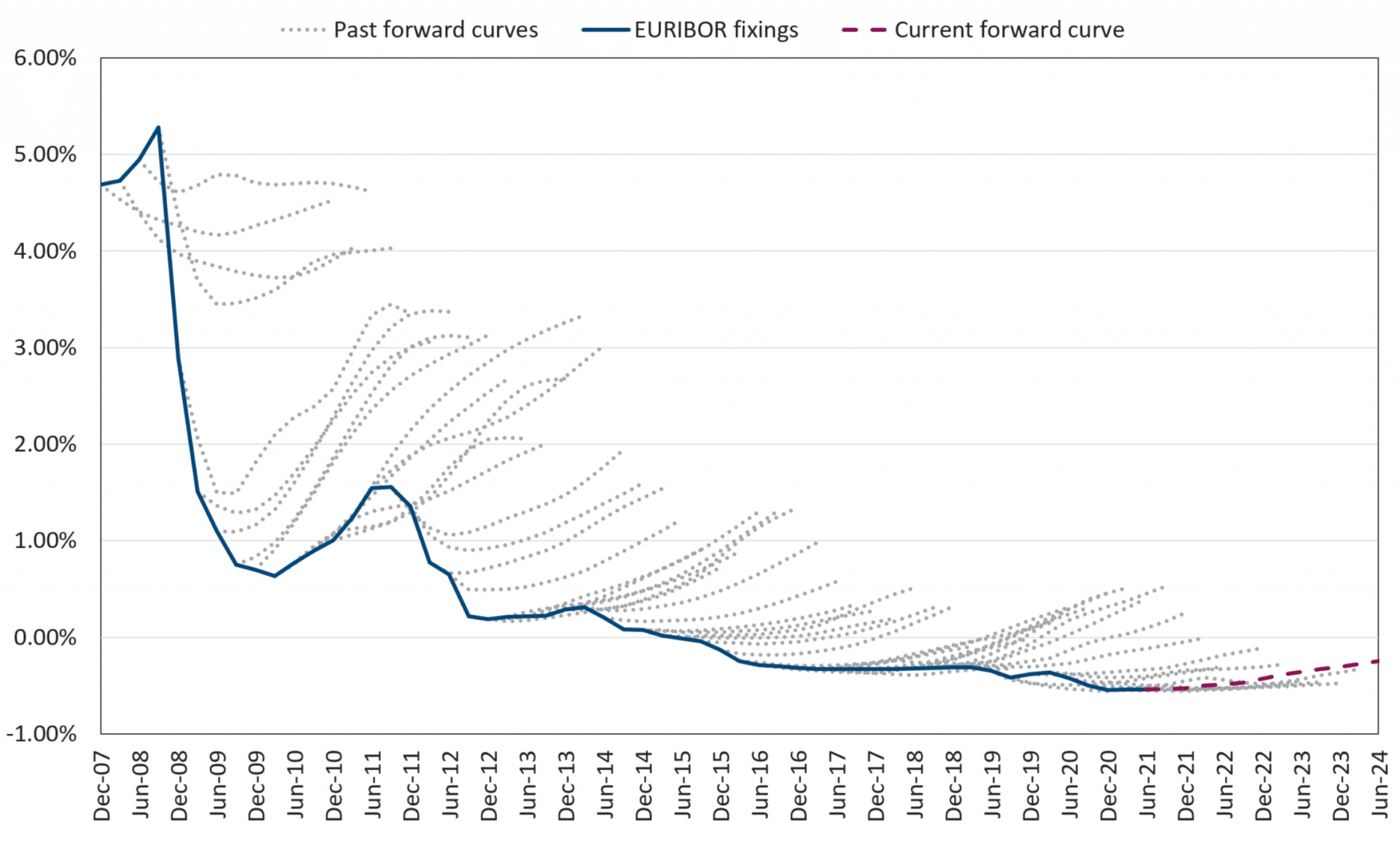

Evolution Of The ECB s Refinancing Rate And 3 month Euribor Jan

Spread Between 3 month EURIBOR And 3 month GC Repo Rate Download

/img-s3.ilcdn.fi/947c9f857030c586172e0e7fb1f1fa0104fe86dd755dd6b18e4f5a6cb5aa3a8e.jpg)

12 Or 3 month Euribor For A Mortgage One Image Reveals The Very Best

12 Kk Euribor Ennuste Korkomarkkinoiden Suuntaukset Vuodelle 2025

CUANDO BAJAR EL EURIBOR PREVISIONES EURIBOR 2023 2024 2025 YouTube

3 Month Libor Vs Euribor Spread Is At Its Highest Level Since 1999

SOFR Curve MacroVar

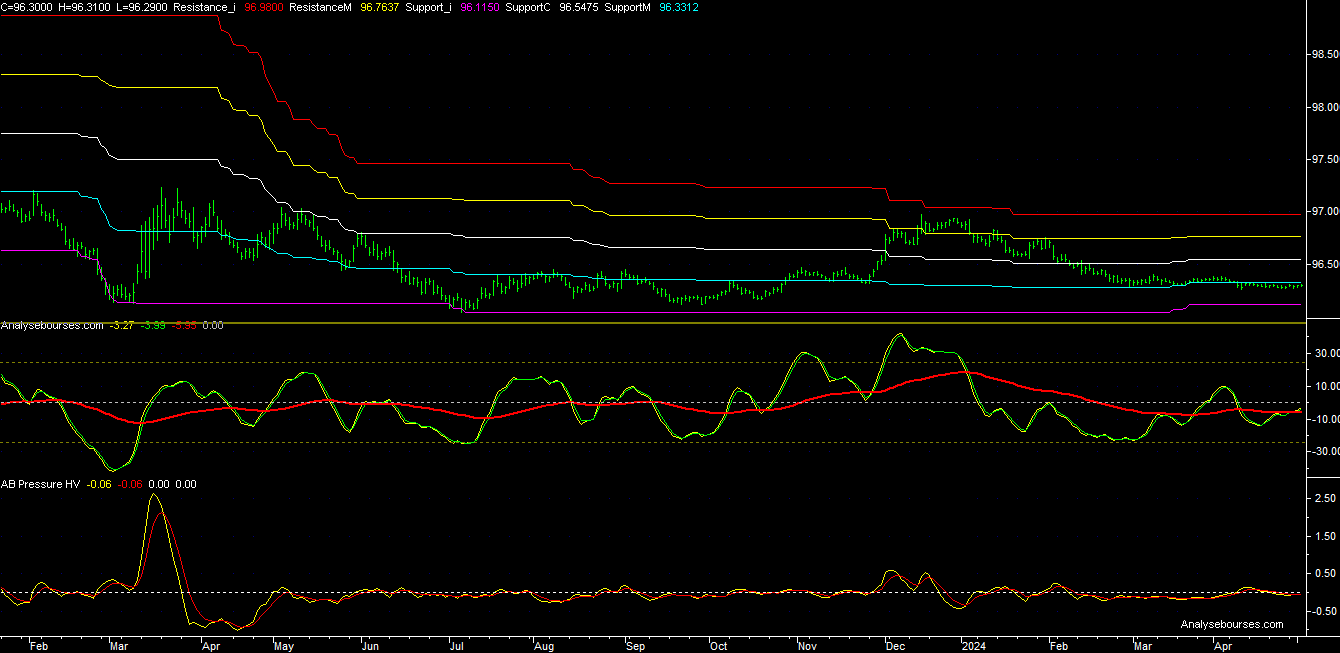

3 Month Euribor Future Forward Curve Spreads Volatility

3 Month Euribor Future Forward Curve Spreads Volatility